Why Choose a Lender That Requires Less Cash to Close?

Some real estate investors have an abundance of cash, while others are cash poor with a healthy income. Still other potential investors may be both cash and income poor. Within each of these various financial situations are several other variables that play a role in determining the most appropriate investment arrangement.

For example, some wealthy investors may have plenty of assets but not be able to access them because they are tied up in properties or the stock market. The amount of liquid cash an investor has available is an important factor when choosing a lender. Each lender has different terms and down payment requirements. Investors should make sure their loan terms match their financial situation — especially when it comes to the amount of cash needed to close the loan.

For example, some wealthy investors may have plenty of assets but not be able to access them because they are tied up in properties or the stock market. The amount of liquid cash an investor has available is an important factor when choosing a lender. Each lender has different terms and down payment requirements. Investors should make sure their loan terms match their financial situation — especially when it comes to the amount of cash needed to close the loan.

Experienced investors know that in exchange for a smaller cash investment, rates, points, and fees may be higher than they would expect on a loan with a significant cash requirement to close. Don’t mistake this as a bad deal though, there are many benefits to keeping more of your liquid cash in pocket that more than make it worth searching for a lender with the lowest cash requirements. Bringing less cash to the table can benefit investors with any financial situation. Here are some ways a real estate investor can benefit from bringing less cash to closing.

Benefits of Real Estate Investment Loans that Require Less Cash to Close:

1) Use Cash Reserves to Fund Repairs

Most lenders will reimburse you for repair work that is complete through an escrow account it has set aside for you. No matter how quick inspectors and lenders are, there will be some lag time between ordering an inspection and receiving funds. While the speed of a draw release is also an important factor when choosing a lender, the more liquid cash you have on hand, the fewer variables there will be that may delay your project. Waiting on inspectors or bank transfers can be eliminated with a dedicated cash reserve.

2) Use Cash Reserves to Invest in Multiple Properties

Once an investor establishes themselves as a successful flipper by have a few profitable properties under their belt, it may be time to expand the business by investing in multiple projects at one time. Bringing less cash to closing allows for borrowers to consider the idea of working on more than one property at a time. As long as your credit stays high and you’ve proven yourself to be a smart, capable investor, lenders will be more comfortable lending you the funds for several properties with less cash down on each.

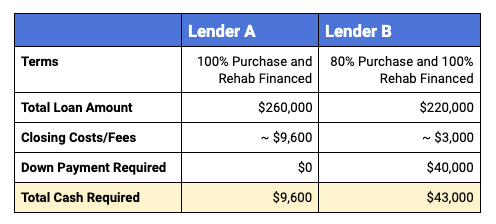

Below are two scenarios. In the example, Lender A offers 100% financing on both the purchase price and rehab costs. Lender B offers only 80% financing of the purchase price but also 100% of the rehab costs.

For the Following Property:

Purchase Price: $200,000,Rehab Budget: $60,000,ARV: $400,000

Investors with less cash available will appreciate the lower cash outlay required by Lender A and be able to use that cash for other things on the project. Even for investors for whom a single $50,000 cash payment is not a problem, paying less to close a single loan keeps more cash available to close on several loans for concurrent projects. This is how you build a real estate empire with less cash in the bank!

3) Use Cash Reserves to Cover Surprise Expenses

When a rehab budget is finalized in the early stages of the loan process, an investor typically cannot increase that amount after that. Experienced investors will tell you that something unexpected always comes up during the project. If the investor needs 20 windows installed instead of 12, a new $8,000 roof is needed after it was thought that $1,000 in repairs would do, or serious structural issues had gone undetected in the due diligence period and have since come to fruition, they’ll need a cash reserve to float the new expenses. When surprises arise, having liquid cash can prevent the surprise expenses from becoming devastating project killers.

4) Use Cash Reserves to Diversify Your Portfolio

Real estate is only one of many investment vehicles used to diversify an investment portfolio. The stock market, peer-to-peer lending, etc. are all viable options to invest money and make a profit. Keeping money liquid allows you to keep these options open should the right opportunity present itself while you are working on your project. Instead of tying up your money in a rehab project, you can keep it available to work for you in other ways.

Real estate is only one of many investment vehicles used to diversify an investment portfolio. The stock market, peer-to-peer lending, etc. are all viable options to invest money and make a profit. Keeping money liquid allows you to keep these options open should the right opportunity present itself while you are working on your project. Instead of tying up your money in a rehab project, you can keep it available to work for you in other ways.

It is up to each investor to evaluate their financial position and make a judgement call as to the best route of financing. It may be in his best interest to put down 10-25% to receive a slightly lower interest rate and points, but we are finding that the less cash to closing strategy fits all types of investors, from first timers to the real estate tycoons. Contact us today to get an estimate of your expenses and see if you qualify for a 100% purchase and rehab loan with Rehab Financial Group.