Real Estate Formulas

A good investor is one that can produce repeat success. Finding success can be hard work. Repeated success can seem impossible.

The fact is that it’s not impossible. Predictable real estate investment success is calculated. Good investors have a long list of real estate formulas. When properly used, these formulas will help determine when potential projects are favorably priced, help the investor understand how much cash is needed, identify a target selling price, calculate timelines and project profit margin. The list goes on!

The articles below and the real estate calculations within them are the tools needed to convert lucky real estate hobbyists into calculated real estate investors.

Unexpected House Flipping Costs that Every Real Estate Investor Should Know

When investing in real estate, there are many hidden costs that a real estate investor may not think of or anticipate at the beginning of the project. These extra costs are what will make the difference between a successful investment and an unsuccessful one.

When figuring out the costs of your house flip, Rehab Financial always encourages a borrower to overestimate time and costs. If the project will still be successful even if the unforeseen happens, then it is a great project to invest in. If it gets finished without unforeseen delays and costs, then it will be a great project!

Use our House Flipping Calculator to see how much flipping a house will cost!

Real Estate Investment Costs

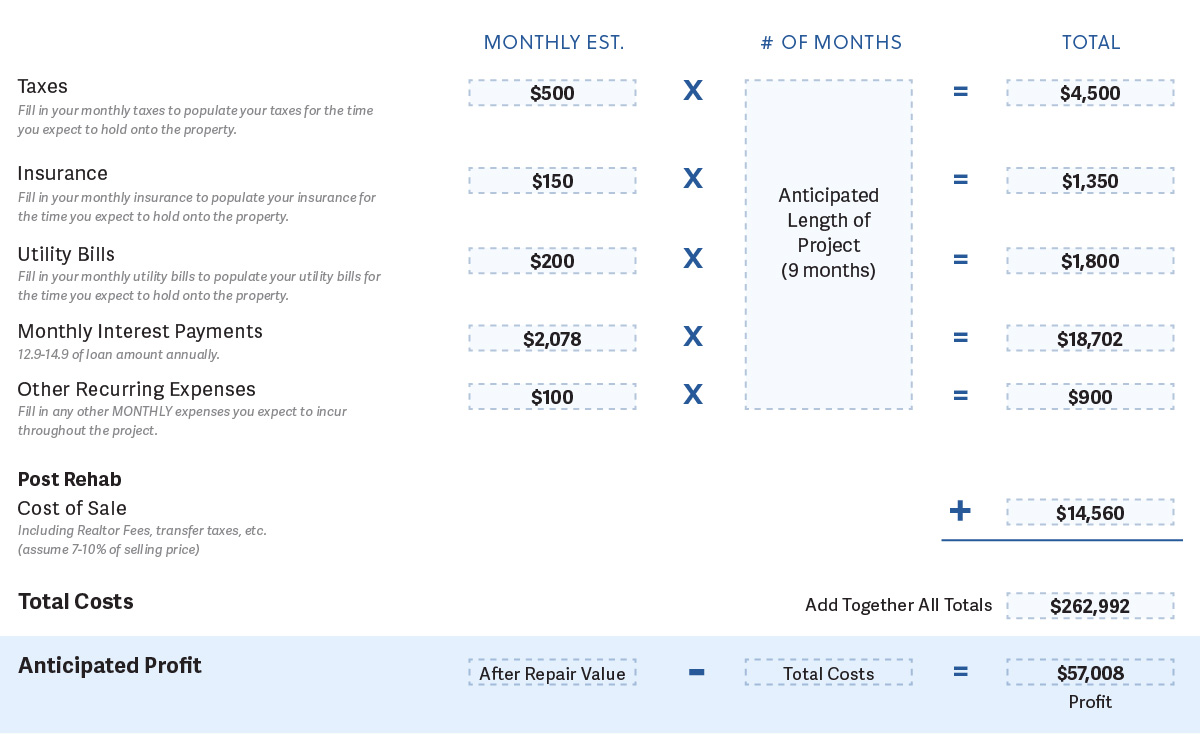

Below is an illustration of costs to be anticipated in real estate investing, using the template found in our business plan template. This example shows a project that could be done in 6 months, but being cautious, the estimate is done as if the loan will be outstanding for 9 months.

As you can see, even at 9 months, this is a very profitable project. If it gets done sooner, it will be even more profitable. Please note: the amount of the down payment is not added to the “Total Costs,” as that is already included in the purchase price and does not represent an additional cost.

How Hidden Real Estate Investment Costs Can Impact You

If the investor in this scenario were to buy the property for cash, the closing costs would be less and the monthly payments eliminated, therefore raising the profit even higher. However, this investor would then have significant cash tied up in the project – approximately $230,910* adjusted for closing costs and monthly payments.

$230,910 = $170,000 purchase price + $38,000 rehab costs + $700 permits + $4,500 taxes + $1,350 insurance + $1,800 utility bills + $14,560 selling costs

*This calculation does not include the lost opportunity the investor faces of the cash invested elsewhere.

Taking into account the time value of money, and assuming a gain of 8% per year on funds, this would represent a hidden cost to the buyer of an additional $14,345 in lost gains on the funds because they were tied up in the project.

Monthly Lost Gains on Funds

$239,090 X 8% gain per year on funds / 12 months = $1,593.93 per month

Total Lost Gains on Funds

$1,593.93 per month x 9 months = $14,345

The real estate investor could have even used these funds for a down payment in a second property!

The investor that borrowers funds for the property is only laying out closing costs at the beginning of the project. The investor then uses her lender’s funds for the purchase and rehab costs, paying monthly interest payments for the use of the funds and avoiding any single large cash outlay.

Accordingly, this investor is not losing a significant amount of the value of money over time by having cash tied up in the project. Nor do they have any lost opportunity costs by not being able to use their cash for other investments. When viewed from this perspective, borrowing the money is not as expensive as it may seem.